Is It All About The Interest Rate?

Is the Interest Rate what matters the most when it comes to getting a mortgage?

Naturally, when shopping for a mortgage, one looks for the best interest rate possible. The amount of interest is the price you are paying for the mortgage, so the lower your interest payments, the better off you are. The question then becomes this: does a lower interest rate always guarantee you lower interest payments? You must have heard your personal banker or a mortgage agent tell you: “It’s not just about the rate”. And you thought to yourself “Yeah, right.” So is it possible to save money with a higher interest rate on your mortgage?

The answer is “Yes”. You can do this by taking advantage of the prepayment privileges on your mortgage, i.e. by paying more than the required minimum payment. The amount of allowed prepayment varies from mortgage to mortgage. You need to take this into consideration when choosing a mortgage as higher prepayment privileges may result in substantial savings.

Let’s compare the following two scenarios:

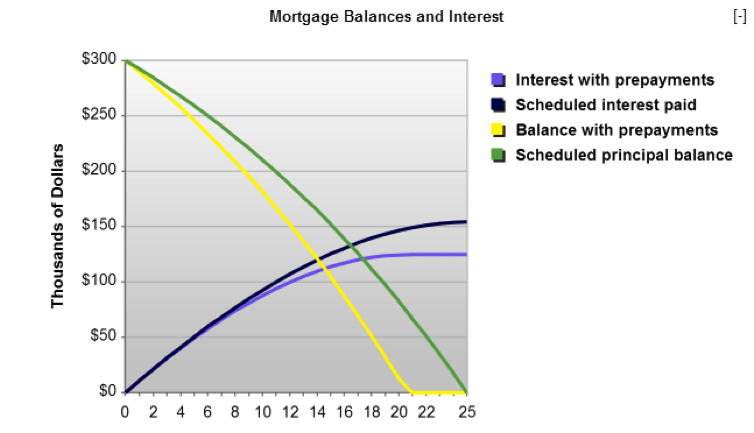

1) $300,000 mortgage at 3.5% with a 25 year amortization where you make regular monthly payments

2) $300,000 mortgage at 3.6% with a 25 year amortization where you pay additional $200 per month on top of the regular monthly payment

In scenario 1 you will be paying $1,497.81 per month with total payments of $449,343.48 over the life of the mortgage.

In scenario 2 your monthly payment is $1,513.69 plus $200 for a total of $1,713.69 per month. The total payments over the life of the mortgage are $424,574.45, which means you will pay $24,769.03 less in interest compared to scenario 1. Additionally, in the second scenario the mortgage will be paid out 4.3 years sooner!

Your Mortgage Amortization in a simple chart

This is a simplified example assuming constant interest rates for the life of the mortgage. However, it still proves a point: you can save thousands of dollars by putting additional money on your mortgage even with a higher interest rate.

Therefore when shopping for a mortgage pay close attention to the prepayment privileges that come with it and do take advantage of them whenever possible.